Star (XLM) and Market Trend Trade Volume Model Analysis

The cryptocurrency world is known for its rapid and unpredictable character, making it challenging to make conscious trade decisions. One critical aspect that merchants and investors should consider is market trends and trade models that can provide a valuable insight into a particular asset, such as a star (XLM) in a possible direction.

What is the volume of trade?

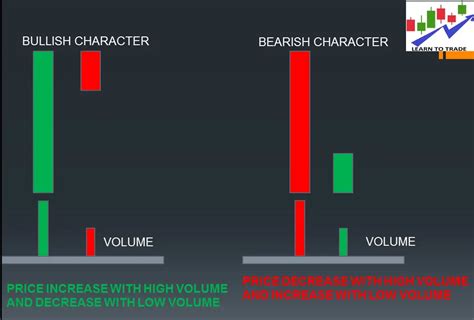

The volume of trade refers to the total volume of cryptocurrency exchanged with exchange over a given period, usually daily or weekly. It is calculated by counting all buying and selling activities on different stock exchanges. A strong sales point indicates a high level of liquidity that can be beneficial to merchants who want to buy or sell XLM.

Trading Volume Models Analysis Star

Recently, Stellar has experienced a significant increase in sales, making it attractive to property for traders and investors. Here are some key insights in XLM trading volume models:

* Short -term sales

: In 2021, XLM short -term sales increased by more than 10%during a strong market sentiment. This suggests that XLM has a very liquid value and can be marketed with relative lightness.

* Long -term sales volume : And vice versa, XLM long -term sales have been relatively low in recent years, which may indicate that there is concern about active activity or the overall cryptocurrency market.

* Seasonality : The XLM trading model has a clear seasonal trend with increasing activities during periods of strong economic growth and reduced activity during recession periods. This could indicate a correlation between XLM prices and other assets such as stocks or goods.

Star market trends

In recent months, the cryptocurrency market has experienced considerable volatility, with prices almost daily fluctuating wildly. Here are some of the main trends that have been observed:

* Resistance levels

: The price of XLM has opposed a number of main levels of resistance, including 20 and 50 day changing average. This suggests that there is a high interest buying level for asset.

* Support Levels : And vice versa, XLM has supported a number of main support levels, including 10 and 20 -day changing average. This indicates a high level of sales pressure on the asset.

Conclusion

Star (XLM) trading model analysis can provide valuable insight into market trends and moods. By checking short -term and long -term sales, traders and investors can determine the potential for buying or selling and make more informed decisions on their portfolios. In addition, understanding these trends can help traders to remain ahead of the curve in the rapidly changing cryptocurrency market.

suggestions

Based on our analysis, we recommend:

* Buy XLM : With a strong trade model and rising price resistance, we believe that XLM needs to be repaired and can be worth considering a long -term investment.

* Selling XLM : And vice versa, reducing sales volumes in recent months indicate that XLM can be sold and entitled to greatness.