How to set Trading Models for Trade near the Protocol (Close)

Cryptocurrency Trading is increasingly complicated as various cryptocurrencies and chips suffering from high price fluctuations. The Reverse Assets, such as a Close Protocol (Close). In this article,

What are the models of change?

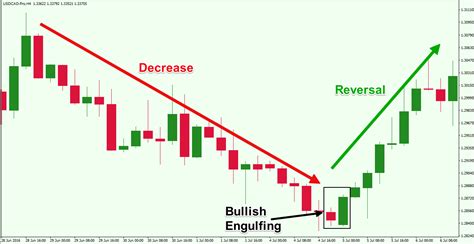

Reverse models indicate a model of a specific type diagram that signals the upcoming increase or decrease in prices. The cryptocurrency. Having identified Reverse Models, Traders and Investors Can make

Why is it important to change the model?

Models trade includes These models are based on historical data and can be used to Anticipate Price changes before they occur. Once these models have been identified, traders and investors can:

- Increase your ability to make testable transactions

:

2.

The Nearest Neighbor (NN) Model: Overall Change Model

The nearest neighbor (nn) model is the main change model that covers the price, from the central point and returns to that point. When it comes to cryptocurrency trade, this model can be observed in several ways:

- Pricing moving :

- Return to the Central Point :

How to set Trading Models for Trade near the Protocol (Close)

Diagrams in the Nearby Trade:

- The nearest neighbor (nn) Model : Observe the price moves away

2.

- Relative Strength Index (RSI) : RSI helps determine overcrowded and resold conditions. When RSI exceeds 70, it can mean a possible change.

- Bollinger Group : Bollinger Groups Provide Additional Insights on volatility and trends.

Example of the Models Already

TRADING NEARBY, Let’s Consider the Example:

Suppose you are analyzing close (close) Price Chart Within 1 Hour. The chart shows a great tendency when the price reaches a ma and forms a head and shoulder model.

The nn model turns out when you notice that the price is moving away from the Central Point (Head and shoulder top)

Exposure to Insights

When marked with Trading Models, Trading Near or Any Other Property:

1.

2.

3.