USDT growth: Understanding the power of Tether’s dominance on cryptocurrency market

In recent years, the cryptocurrency market has undergone significant fluctuations, many investors seeking stability and security in the digital assets. One of the most traded and complained cryptocurrencies on the market is USDT (Tether), a stablecoin related to the US dollar. In this article, we will deepen in the world of connection and its role in the crypto market.

What is the connection?

Tether Limited, also known as Tether, is an American Cryptocurrency exchange that was founded in 2012 by a team of entrepreneurs. The main objective of the company is to provide a reliable and stable platform for buying and selling cryptocurrencies. To achieve this goal, Tether has developed a unique approach to the traditional Fiat currency market.

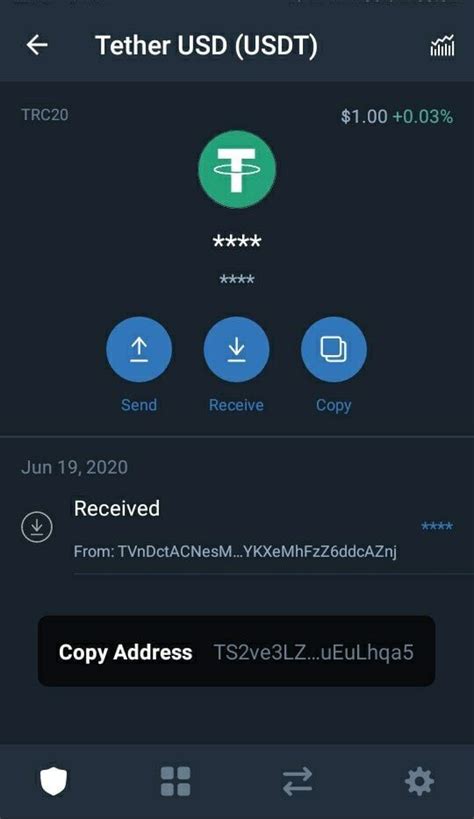

Tether uses a system called “pegging” or “tethering”, where USDT is fixed at a precise value in relation to the US dollar. This means that a USDT currency can be transformed into $ 1. The main exchange of exchange, Bitcoin (BTC), serves as a reference point for all other cryptocurrencies on its platform.

How does the connection work?

The connection system works on a decentralized blockchain network, allowing efficient and safe transactions throughout the globe. When you buy or sell USDT, your transaction is suitable for the “stable” currency of another part. This process takes only 10-30 seconds to be completed, which makes it faster than traditional payment systems.

Tether’s stablecoin system ensures that prices remain stable, even during high market volatility periods. For example, if Bitcoin experiences a significant decrease in short -term prices, Telether will adjust its reserves to maintain a stable value in relation to the US dollar. This prevents traders from taking advantage of the market fluctuations and helps promote confidence in the cryptocurrency market.

The role of Tether on the crypto market

USDT plays a crucial role on the crypto -critico market, acting as:

- Liquidity provider : Tether offers liquidity for various cryptocurrencies, allowing investors to buy or sell them easily.

- Stable anchor : The Stablecoin system ensures that the prices remain stable, even during the volatility periods of the market.

- Regulatory Hub : USDT is widely recognized as a spare asset in the crypto space, which makes it an attractive option for institutional investors and renowned exchanges.

Why does Tether’s dominance matter

Tether’s dominance on the cryptocurrency market has several implications:

- Increased adoption : The Stablecoin system makes the cryptocurrencies more accessible to a wider audience, which causes growth and adoption.

- Improved investors’ confidence : USDT stability offers investors peace of mind, allowing you to invest without worrying about price fluctuations.

- Reduced risk : The Stablecoin system minimizes the risks associated with market volatility, which makes it an attractive option for traders and investors.

Challenges and controversy

While Tether has gained a significant traction on the crypto -critico market, it is not deprived of its challenges:

- Regulatory scrutin : USDT stablecoin status raises regulatory problems, which can affect its growth.

- Fiat-Crypto conversion risks : The process of transforming FIAT coins into cryptocurrencies can be complex and subjected to errors, which could lead to financial losses.

Conclusion

Tether’s growth to importance on the crypto -critic market is a will of its innovative approach and adaptability. As the cryptocurrency landscape continues to evolve, Tether’s stablecoin system remains an attractive option for investors looking for stability and security. While the challenges and controversy persist, USDT dominance will probably take your favorite choice for many investors and traders.